Want to pay for college using your home? A cash-out refinance lets you use money from your house to pay for school. Think of it like getting a new home loan, but taking some cash out at the same time.

You need to own at least 20% of your home and have good credit scores to do this. The good news is you might pay less in interest than with normal student loans. You can even save money on taxes!

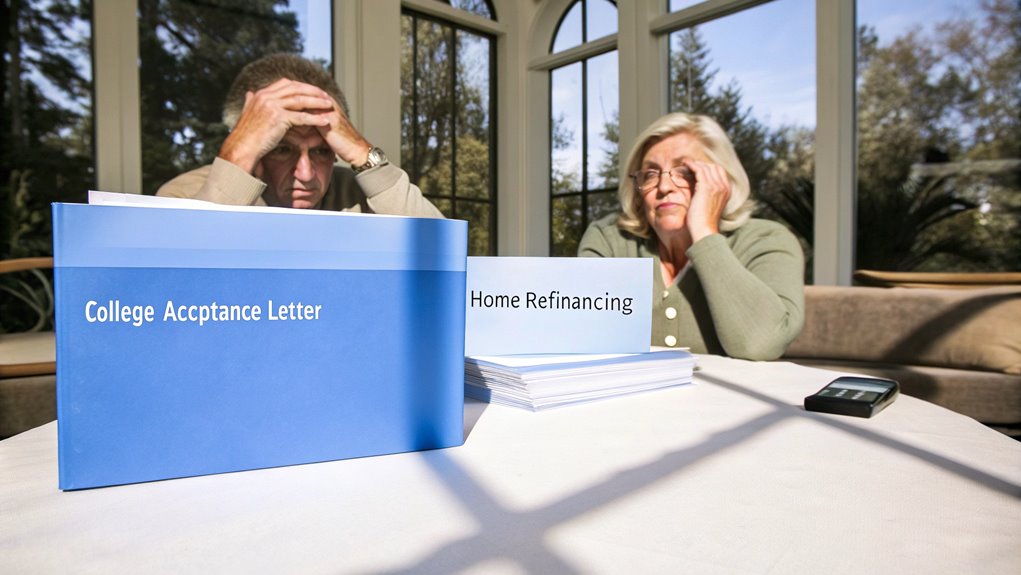

But be careful. Your house payment will go up each month. If you can't make the payments, you could lose your home. This is a big choice that needs lots of thinking.

To make it work best:

- Plan 6 months before you need to pay for school

- Wait until loan rates are low

- Look at all your money carefully

This way can help pay for school, but make sure you know what you're doing to keep your home safe.

Understanding Cash-Out Refinance Basics

Getting money from your home to pay for college is possible with a cash-out refinance. This means you get a new, bigger home loan to replace your old one. You get the extra money in cash, which you can use to pay for school costs like classes and a place to live.

You must own enough of your home first – at least 20%. You also need good credit and enough money coming in each month.

Since you're using your home to get this money, you'll pay more each month. Your loan will also take longer to pay off.

The cost of your new loan depends on two things: what banks are charging right now, and how good you're with money. This means you should pick the right time to do this.

Benefits for College Funding

Using your home to help pay for college can be a good choice. You can get all the money you need at once. The cost to borrow this money might be less than what you'd pay for student loans. Plus, you can save on taxes when you pay the interest.

You can use this money any way you want. Pay for classes, a place to live, books, or any other school needs. It's much simpler than getting student loans, which have lots of rules. You won't have to deal with all the hard rules about paying back student loans.

But keep in mind – your house is at risk if you can't pay. Make sure you can pay your new house bill each month before you choose this path.

Risks to Consider

When you use your home to pay for college, you need to be careful. It's like putting your house at risk. If you can't pay your monthly bills, you might lose your home. Your house payments will go up each month, and this might make it hard to buy other things you need.

Think about it: You worked hard to own part of your home. Now you want to trade that for school loans tied to your house. This isn't like normal school loans – you can't get help if you have money troubles later.

It will take longer to own your home fully. You'll also pay more money over time. If loan costs go up, you might end up paying even more than you'd with normal school loans.

Home Equity Requirements

Want to use your home to pay for college? You need to own enough of your home first. Most banks want you to keep at least 20% of your home's value. This means if your home is worth $300,000, you must keep $60,000 in it.

How much you can borrow depends on what your home is worth now. Take away what you still owe on your home loan. Then take away the money you must keep in it.

A home expert will check how much your home is worth. But be careful – if home prices go down, you might end up owing more than your home is worth. So take time to do the math before you decide.

Interest Rate Comparisons

Let's talk about money for school and homes. Think about what you'll pay before you make a big choice.

You can get money for school in two ways. School loans from the government cost 5% to 8%. Private school loans cost 4% to 13%. You might pay less if you use your house to get money.

When you use your house to get money, you pay less because your house helps keep the loan safe. But you have to pay extra fees of 2% to 5%.

Also, if you turn school debt into house debt, you lose some good things. You can't get help with payments or have some debt forgiven later.

Add up all the money you'll pay over time. This will help you pick the best way to pay.

Tax Implications and Advantages

Taking money from your home loan to pay for college comes with special tax rules you need to know about.

If you list all your tax items one by one, you might get to save some money on your home loan costs. The IRS lets you take off some of what you pay in home loan fees.

You can also get money back from the IRS just for going to school. Two ways to do this are with the American Opportunity Credit and the Lifetime Learning Credit. You can use these credits no matter how you pay for school.

Deductible Interest Rules Apply

Taking money from your home loan to pay for college has special tax rules to follow. Let's keep it simple.

When you borrow money from your house, you can only write off some of the costs on your taxes:

For Your Home:

- You can write off interest up to $750,000 on your main house

- You can write off all the interest on rental homes

- Home loan money must go to fix up your house, not school

For School Costs:

- You can write off up to $2,500 each year on student loans

- You must pick one: either home loan write-off or student loan write-off

- You can't use both for the same money

Keep track of how you spend the money. This helps at tax time.

Talk to someone who knows taxes well to get the most money back.

Tax Credits and Deductions

Going to college is expensive, but tax breaks can help you save money. You can get money back through two special tax credits. The first one is called AOTC, which gives you up to $2,500 for each student. The second one is LLC, which gives you up to $2,000 on your taxes.

When you borrow money for school, you can save on taxes too. You can take off up to $2,500 in loan interest from your taxes. This works even if you use your house to get the money for school.

But be careful – you can't use the same costs twice to save on taxes. If you claim house loan interest, you can't use those same costs for school tax credits.

Talk to a tax helper to make sure you get all the savings you can. They know the rules and can help you do things right.

Application Process Steps

Getting money from your home through a cash-out refinance takes some work. First, you need to get your papers ready. You'll want your tax forms, proof of how much you make, and bank papers.

Look for banks that will help you get money from your home to pay for school. Send your forms to a few banks at the same time. This helps keep your credit score safe. You'll need to tell them where you work and how much money you make. They'll also look at how much your home is worth now.

After you send in your forms, the bank will check everything. They may ask you for more papers, so be ready to help them fast.

The whole thing takes about a month or more, so start early if you need the money for school.

Alternative Education Financing Options

Let's talk about different ways to pay for school without using your home money. You can get student loans from banks. You can use your home value to get money from a bank. Parents can get special loans from the government to help pay for their child's school.

Look at how much each loan costs. See how long you have to pay them back. Make sure you can get the loan before you pick one.

You can also find help in other places. Some jobs help pay for school. Some states give free money for school. You can even make a deal to pay back school costs based on how much you earn later.

Each way to pay for school has good and bad points. Pick the one that works best for you and your money.

Evaluating Student Loan Alternatives

Your path to paying for college has many choices that are better than using your home's value. Let's look at them.

First, check out federal student loans. These loans can work with your income. They may even forgive some of what you owe later.

Banks and credit unions have their own student loans too. Many give good rates, and you won't risk losing your home.

Free money is the best! Look for:

- Awards for good grades

- College grants

- School jobs that help pay tuition

Many students mix different ways to pay. They use:

- College savings accounts

- Parent loans

- School payment plans that split the big bill into smaller ones

Try all these ways first. Only think about using your home's value as a very last choice.

Beyond Traditional Financial Aid

Paying for school can be hard. But there are many ways to get help beyond just loans from the bank.

Think about new ways to pay for school. One way is to share some of your future pay instead of taking out loans. Many jobs can also help pay for school if you work for them.

You can ask friends and family to help through special websites made for students. Some states let you buy school at today's price for later use. Many groups give money to students who want to work in certain jobs.

Before you pick any way to pay, make sure you know what you must do. Ask lots of questions. Read all the rules. Then pick what works best for you.

Smart Borrowing Strategies

Taking money from your home to pay for college is a big choice. Let's make sure you do it right.

First, look at what it will cost you. Add up the new house payment, fees, and how long you'll be paying. Then check if school loans might cost less.

Only take what you really need. Just borrow enough to pay for school and books. Keep some of your home's value safe. Think about how much money you'll make later and what you can pay each month.

Save some money for tough times. Don't spend all the cash at once. Spread it out over your school time so you have enough money until you finish.

Timing Your Refinance

When you want to use your home to help pay for college, timing matters. Start early – at least six months before you need to pay for school. The whole process takes about one to two months to finish.

Keep an eye on two things: low interest rates and how much your home is worth. You want rates that are much lower than what you pay now. Also make sure your home is worth more than when you bought it. You should own at least 20% of your home's value.

Don't wait too long to start. The best time to do this is from October to February. Banks are less busy then. They may give you better rates and work faster on your loan during these months.

Making the Final Decision

Think about your home and money before getting a cash-out loan for school.

Look at all the ways you can pay for school first. Check what banks will charge you. Make sure you can pay your new house payment each month without worry.

Talk to someone who knows about money. They can help you make a smart choice. They'll look at your job and savings to see if this is right for you.

Keep in mind that you're using your house to pay for school.

If you want to do this, make a good plan to pay the loan back. Your house is very important, so protect it.

Pick what works best for you and your money now and later.